A lien placed on underlying belongings in the event the delinquent occasion ought to be unable to fulfill their debts.

An expatriation tax is often a tax on people who renounce their citizenship or residence. The tax is frequently imposed based on a considered disposition of all the person's home. One illustration is The us beneath the American Work opportunities Creation Act, wherever any particular person who may have a Web worth of $two million or an average earnings-tax legal responsibility of $127,000 who renounces his or her citizenship and leaves the state is mechanically assumed to possess done so for tax avoidance reasons and is also matter to a higher tax fee.[22]

Estate tax—Charge placed on the fair industry price (FMV) of property in an individual’s estate at the time of Demise; the entire estate need to exceed thresholds established by state and federal governments

Karl Marx assumed that taxation could well be needless just after the arrival of communism and looked ahead on the "withering away of your condition". In socialist economies including that of China, taxation played a minimal role, due to the fact most authorities money was derived with the ownership of enterprises, and it had been argued by some that monetary taxation wasn't needed.

Tax farming, the basic principle of assigning the duty for tax revenue selection to private citizens or groups.

Other tax units may perhaps isolate the reduction, these that business enterprise losses can only be deducted versus business enterprise earnings tax by carrying ahead the loss to afterwards tax a long time.

They explained financial concept has centered on the necessity to "enhance" the program via balancing performance and fairness, being familiar with the impacts on production, and consumption together with distribution, redistribution, and welfare.

An import or export tariff (also referred to as customs obligation or impost) is a charge for your motion of goods via a political border. Tariffs discourage trade, and they may be employed by governments to guard domestic industries. A proportion of tariff revenues is commonly hypothecated to pay The federal government to keep up a navy or border police. The common ways of dishonest a tariff are smuggling or declaring a Bogus value of goods.

This means that tax incentives never contribute to the event of your sector up to it is believed to add.[seventy seven] Assistance towards the IT field and tax incentives were being proven during the 2000s in Armenia, and this example showcases that these kinds of policies will not be the warranty of immediate economic expansion.[seventy eight]

The other of a progressive tax is usually a regressive tax, exactly where the helpful tax rate decreases as the amount to which the speed is applied improves. This outcome is often manufactured where indicates testing is utilized to withdraw tax allowances or state benefits.

An excise obligation can be an indirect tax imposed upon products check here during the entire process of their manufacture, output or distribution, and is generally proportionate for their amount or worth. Excise responsibilities were being 1st introduced into England from the yr 1643, as Component of a plan of profits and taxation devised by parliamentarian John Pym and accredited from the Lengthy Parliament. These duties consisted of rates on beer, ale, cider, cherry wine, and tobacco, to which list were being afterward additional paper, soap, candles, malt, hops, and sweets.

commercialappeal.com wishes to ensure the most effective experience for all of our readers, so we designed our web-site to take advantage of the latest technology, making it speedier and much easier to use.

All nations Have got a tax system in place to buy general public, common societal, or agreed national wants and for that functions of presidency.[citation desired] Some countries levy a flat share price of taxation on particular yearly money, but most scale taxes are progressive determined by brackets of annually earnings amounts.

The property’s assessed price is decided by a house assessor appointed via the regional government. Reassessments are usually executed every one to five years.

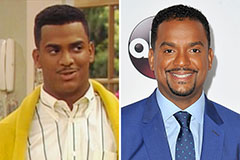

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now!